- Thu. Apr 25th, 2024

Latest Post

World Malaria Day 2024: Fighting for Equity in the Fight Against Malaria

In 2024, the theme for World Malaria Day is “Accelerating the fight against malaria for a more equitable world,” which highlights the need to address inequalities in access to prevention,…

Beat Malaria: Celebrating World Malaria Day 2024 and Promoting Equal Access to Prevention, Detection, and Treatment

This year, World Malaria Day 2024 will be observed on April 25th with the theme of “Accelerating the fight against malaria for a more equitable world”. The focus is on…

The Complex Intersection of Human Rights and Autonomous Intelligences in a World of AI-Powered Law Enforcement: A Closer Look at Accountability, Bias, and Privacy Issues.

The integration of artificial intelligence (AI) in technology, law enforcement, and court systems poses significant challenges for accountability and the application of human rights to autonomous intelligences. One of the…

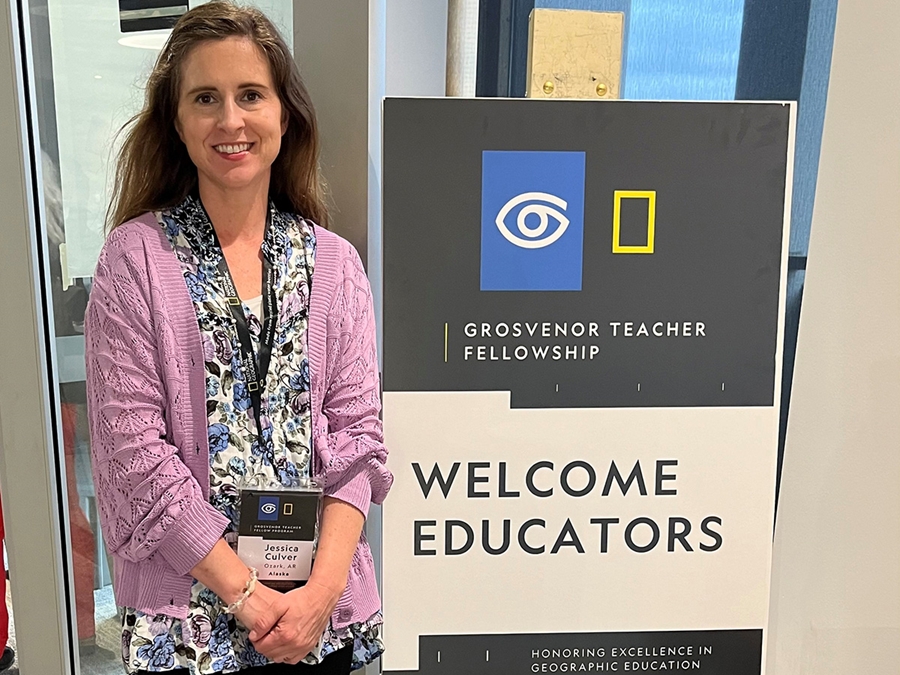

Exploring the Wilderness through Global Education: Dr. Jessica Culver’s Grosvenor Teacher Fellowship

Dr. Jessica Culver, a doctoral student in the College of Education and Health Professions Adult and Lifelong Learning program, has been awarded the 2024 Grosvenor Teacher Fellowship. This prestigious initiative…

Spring into Science: Beatrice High School Science Club Hosts Annual Plant Sale and Teaches About Plant Care

The Beatrice High School science club is hosting its annual spring sale this week, and it’s a great opportunity for the community to purchase some beautiful plants. This event is…

From Hops to Gold: The 2024 World Beer Cup Awards Celebrate Global Brewing Excellence

On April 24th, The Venetian Las Vegas hosted the 2024 World Beer Cup awards, organized by the Brewers Association to celebrate brewing excellence on an international scale. This competition is…

Celebrating Innovation and Equity: The STATUS List 2024 Event Brings Together Leaders to Discuss Critical Issues Facing Healthcare

On Wednesday night, physicians, researchers, CEOs, reporters and other prominent figures gathered in downtown Boston to celebrate the STATUS List 2024 of STAT. The event showcased the honorees from this…

Navigating Change: How Industries are Evolving in Texas and What it Means for Workers

Texas is currently experiencing a steady growth in jobs and the labor force, with over 15 million working Texans. However, as with any economy, there are always uncertainties on the…

Revamping Your Kitchen on a Budget: FunCycled’s Creative Solutions in Wynantskill

FunCycled is a local family-owned business in Wynantskill that started as a flipping company in 2021 and later expanded to offer kitchen cabinet painting and interior design services. Their goal…

Sizzling Celebration: World’s Biggest Fish Fry Returns to Paris, Tenn. with Abundant Food and Exciting Parade

The 71st annual World’s Biggest Fish Fry returned to Paris, Tenn. on April 20th. This event is a community-wide celebration and a kickoff festival for West Tennessee that attracts people…