- Sat. Apr 20th, 2024

Latest Post

Hospital-Associated Infections: Understanding the Gap in Urban vs. Rural Healthcare Facilities through Epidemiological Analysis

Tamia M. Dixon, MPH, an epidemiologist at ASRT, and her colleagues analyzed data from 14 healthcare facilities in nine regions of Louisiana collected in 2022 by the CDC’s National Healthcare…

Recognizing and Nurturing ADNOC Pioneers: Driving Sustainable Growth in the UAE Energy Sector

ADNOC recently organized the annual “ADNOC Pioneers” Forum, which attracted over 1,000 former and current employees. The event aimed to recognize the pioneers who played vital roles in developing the…

Unclear Circumstances Surrounding Shooting Death in Inkster, Michigan

In the early hours of April 19, a shooting occurred in Inkster, resulting in the death of a 35-year-old man. The incident took place at around 1 a.m. at a…

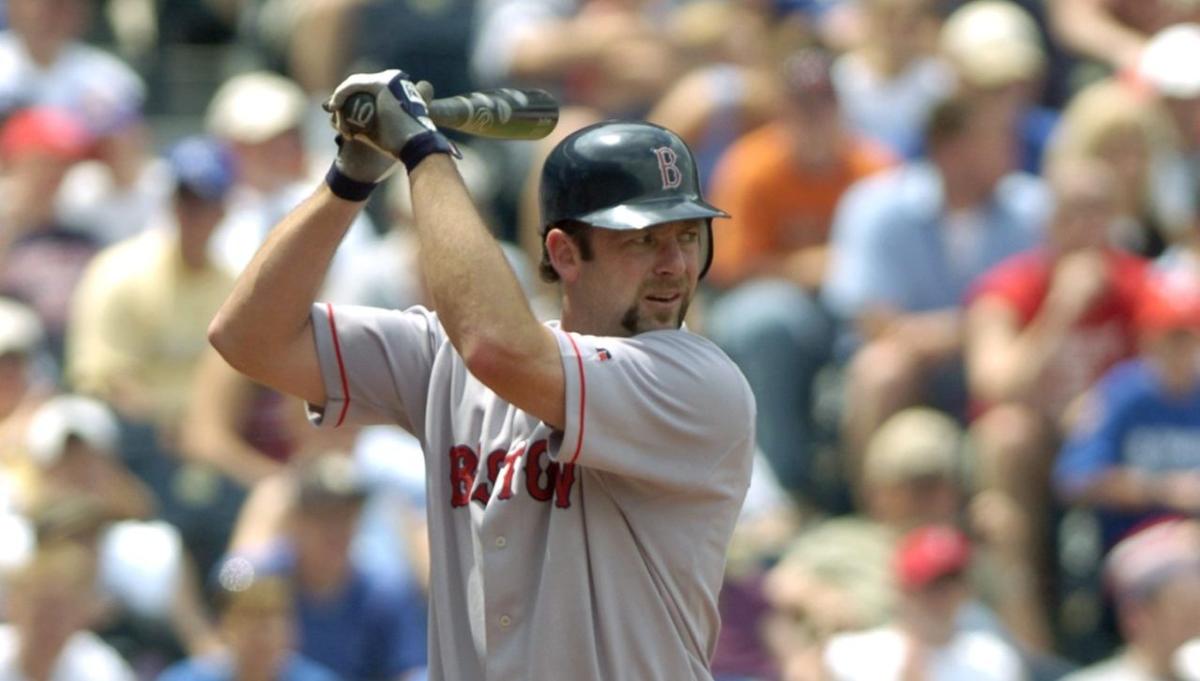

Remembering a Red Sox Legend: Dave McCarty Dies at 54

Dave McCarty, a beloved member of the Boston Red Sox’s 2004 World Series championship team, passed away at the age of 54. The Red Sox announced his passing on social…

Cybersecurity Decreases Across Sectors, Except for File Service; Gambling and Tech Articles Round Out Diverse Offerings

In terms of cybersecurity, there were significant decreases in the number of blocked attacks across different sectors. The mobile application service saw a 2% decrease compared to 2022, while the…

Covering the Home Run: A Baseball Podcast Gets Real on New Uniforms and Player Highlights

The Baseball Bar-B-Cast is back with a new episode, following a relatively quiet Thursday in the baseball world. The hosts discuss various topics, including Texas Rangers pitcher Jack Leiter’s disappointing…

Empowering Communities: The Community Conversation Kit for Preventing Infectious Diseases

The Community Conversation Kit (CCK) is an essential tool for leaders looking to engage with their community about preventing infectious diseases. This kit is designed to facilitate conversations that inspire…

Ethical Corporate Governance: The Controversial Case of the Amirov Brothers and Professor Yitzhak Shapira

The Amirov brothers, newly appointed owners of a controlling stake in the Shufersal retail chain, initially planned to appoint Professor Yitzhak Shapira as chairman of the board of directors with…

Spring into Success: D3 and D4 Host Resource Fair for Detroit’s Small Business Community

On Monday, April 22, 2024, the D3 and D4 Business Districts are hosting a resource fair in partnership with the Detroit Economic Growth Corporation and other resource partners. The event…

Silver Spikes and Iron Will: Stefano Ghisolfi’s Quest to Conquer the World’s Hardest Climbs

In climbing, success and failure often go hand in hand. It is not uncommon to experience multiple failures before achieving a successful ascent. This period of struggle can last for…