- Thu. Apr 25th, 2024

Latest Post

The Ultimate Football Fan’s Dream: Meeting Packers Legend Gilbert Brown at Hoehn’s Huddle

Hoehn’s Huddle, a popular sports bar and grill in Schofield near Wausau, recently announced that Packers legend Gilbert Brown will be hosting a meet and greet at their establishment on…

Free Summer Access: Pittsburgh’s Top Attractions Offering over 100,000 Tickets for a Staycation on a Budget

This summer, Pittsburgh’s popular attractions including the zoo, Carnegie Museum of Natural History, National Aviary, and Phipps Conservatory will be offering over 100,000 free tickets. The Allegheny Regional Asset District…

Despite Recent Losses, Oil Prices Surge Above $83 per Barrel thanks to Weaker Dollar and Strengthening Equities Markets

Despite recent losses, oil prices climbed above $83 a barrel thanks to a weaker dollar that boosted commodities priced in the currency. Additionally, strengthening equities markets provided support to crude…

Jacksonville’s Small Business Community Receives $500,000 in Grants through Comcast RISE Program

This week on This Week in Jacksonville: Business Edition, we are focusing on Comcast RISE, a small business grant program. The program has announced $500,000 in grants for entrepreneurs in…

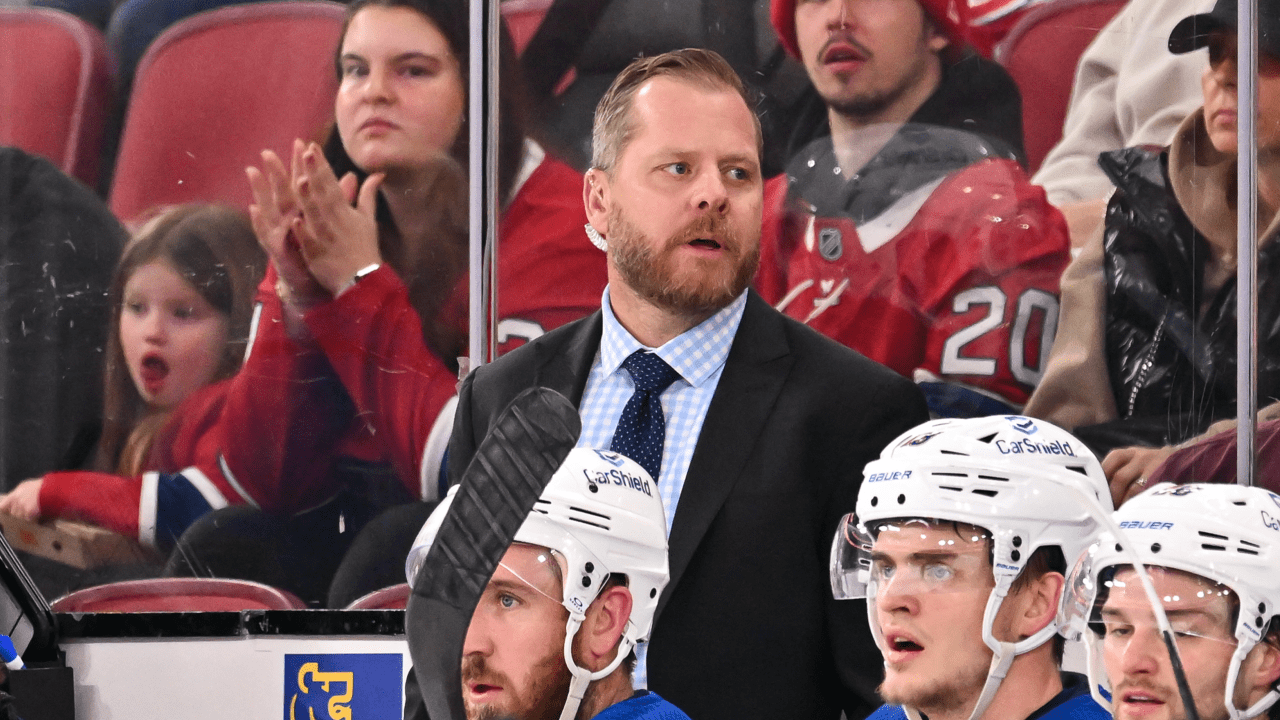

Hockey Canada Welcomes New Assistant Coach Steve Ott to 2024 IIHF World Championship Coaching Staff

Hockey Canada is excited to announce that Steve Ott, Assistant Coach for the Blues, will be joining the coaching staff for Team Canada at the 2024 IIHF World Championship. The…

Designing for Collaboration and Sustainability: The Construction of UVA’s LEED Gold-Certified School of Data Science Building

The design for the building began in January 2020, with collaboration between the architectural teams of Hopkins Architects, VMDO, and the University’s Office of the Architect. Construction was led by…

Avian Flu Threatens Central Coast Communities, Experts Advise Caution and Precautions

The Highly Pathogenic Avian Influenza (HPAI) continues to spread across the country, prompting local doctors and animal experts in San Luis Obispo, Calif. to urge caution around animals. SLO County…

Pittsburgh International Airport Implements Facial Recognition Technology for Enhanced Security and Streamlined Travel Experience

Pittsburgh International Airport has recently introduced the new facial recognition technology to verify the validity of travelers’ identification and flight details in real-time. This latest generation of Credential Authentication Technology…

Tropical Escape: The New Floridaman Sports and Dive Bar Opens on the Beltline in Atlanta

Floridaman, a Gulf Coast-themed sports and dive bar, is set to open next month on the second floor of Breaker Breaker along the Eastside Beltline. The team behind the new…

Unstoppable Team USA Scored Nine Goals in Under 10 Minutes, Leaving Opponents Struggling to Keep Up

Team USA’s top line collaborated for another goal in less than a minute into the middle frame, with Teddy Stiga from Sudbury, Mass scoring after Ziemer fed Hagens into the…