- Thu. Apr 18th, 2024

Latest Post

European Leaders Urge Caution in Response to Tehran’s Attack on Israel

An extraordinary meeting of European Union heads of State and Government took place in Brussels on Wednesday. Originally planned to focus on the economy, the volatile international situation, particularly concerns…

Revolutionizing AI: Logitech’s new software tool and wireless mouse streamline user experience

Logitech has recently introduced a new software tool designed to facilitate the use of artificial intelligence (AI) technology. The Logi AI Prompt Builder is a free tool accessible through the…

Miraculous Win for Texas Rangers as Clutch Double Drives Home Last-Minute Run

On Wednesday, the Texas Rangers emerged victorious over the Detroit Tigers with a 5-4 win. The deciding moment came in the ninth inning when Josh Smith delivered a clutch pinch-hit…

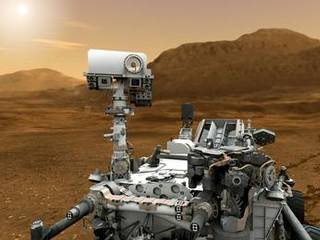

Navigating Mars: The Rover’s Plans for Sol 685 and 686 and the Challenges that Come with Them

On Sol 686, the rover’s plans for tomorrow will be limited as it waits for data to come in from its previous drive. Despite this, the team is excited about…

UVM Women’s Lacrosse Player Ava Vasile Breaks All-Time Scoring Record with Stunning Victory over LeMoyne

UVM women’s lacrosse player Ava Vasile made history by becoming the new all-time scoring leader, surpassing the previous record of 255 set by Sydney Mas. The Cats ended a four-game…

Rising Above Conflicts: Italian Wine Industry Thrives Despite Global Uncertainty

Vinitaly, the world’s leading wine fair, is held in Verona, Italy. During its 56th edition, the wine industry saw some positive news amidst global conflicts. Despite the tensions, wine exports…

Farmers Invited to Apply for $11 Million in Funding for Bird Conservation in the Migratory Bird Resurgence Initiative

The Natural Resources Conservation Service (NRCS) of the U.S. Department of Agriculture (USDA) is currently accepting applications from agricultural producers for enrollment in the Environmental Quality Incentives Program (EQIP). This…

Finding Courage to be Real: Coach’s New Campaign with Rapper Lee Young-ji Encourages Self-Expression and Individuality

Coach’s “Find Your Courage” campaign for spring has launched with rapper Lee Young-ji in a virtual universe. In this new chapter, set in a virtual universe, Lee discovers the courage…

SkyWater Technology Announces Fiscal First Quarter 2024 Earnings Webcast, Showcasing Innovative Solutions for Semiconductor Manufacturing”.

SkyWater Technology, a trusted technology realization partner and semiconductor manufacturer, has announced that it will be reporting its fiscal first quarter 2024 financial results on Wednesday, May 8, 2024, following…

Ravens’ Star Running Back JK Dobbins Heads West to Join the Los Angeles Chargers and Improve Their Rushing Game

The Los Angeles Chargers have officially signed running back JK Dobbins to a one-year contract, as announced by his agency LAA Sports. This move comes after Dobbins spent four seasons…

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/73ET34SD3FEOBEY652MUZO2PWA.jpg)