- Sat. Apr 20th, 2024

Latest Post

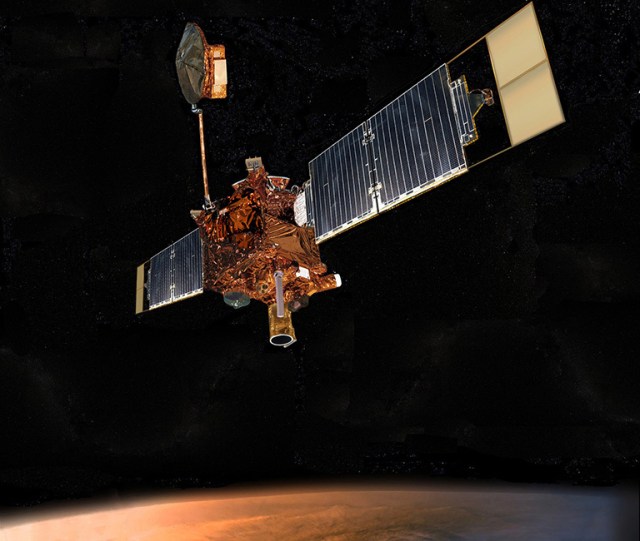

Decade-Long Discoveries: Mars Global Surveyor’s Legacy and the Possibility of Liquid Water on the Red Planet

Mars Global Surveyor was a game-changing spacecraft that spent a decade orbiting the Red Planet, completely transforming scientists’ knowledge of Mars. With its state-of-the-art equipment and cutting-edge technology, the mission…

Poland Secures 250 Million Euros in World Bank Funding for Clean Air Initiative

Poland has recently signed a 250-million-euro agreement with the World Bank to support its Clean Air program, announced Finance Minister Andrzej Domanski. The Clean Air initiative is part of a…

Congressman Steve Cohen Celebrates $21.3 Million Federal Grant for Memphis Head Start Programs

In a statement, Congressman Steve Cohen (TN-9) announced that Memphis Health Center Inc., Porter-Leath, and the Shelby County Board of Education have been awarded grants totaling $21,309,797 from the U.S.…

Oregon Ducks Break World Record in Distance Medley Relay at Eugene Olympics

Brandon Miller, Henry Wynne, Isaiah Harris, and Brannon Kidder set a new world record in the distance medley relay at the Oregon Relays in Eugene, USA on Friday (19). The…

The Greatest Hip-Hop Beefs in Recent Years: Examining Kendrick Lamar and Drake’s Ongoing Feud and J. Cole’s Retraction of His Diss Track

In a recent guest verse on Future and Metro Boomin’s hit “Like That,” Kendrick Lamar reignited his ongoing feud with Drake, sparking what has become one of the biggest rap…

Ronnie O’Sullivan’s Quest for Consistency: Finding the Ultimate ‘Turbo Button’

In a recent interview with Eurosport’s Rachel Casey, snooker legend Ronnie O’Sullivan discussed his desire to find a “turbo button” that would allow him to consistently perform at a high…

Japanese Companies Turn to AI to Predict Employee Resignations, Create More Engaged Workforce

In an effort to retain their young employees, Japanese companies are turning to AI tools for predicting employee resignations. A new tool developed by researchers at Tokyo City University analyzes…

Five Teenagers Shot During Senior Skip Day Party in Greenbelt; One Left in Critical Condition

During a high school senior skip day party in Greenbelt, Maryland, five people were shot at a park. This unfortunate incident occurred at Hanover Parkway in Prince George’s County, where…

Boston Dynamics’ Atlas Humanoid Robot Retires and is Replaced with a Fully Electric Model

Boston Dynamics, a US-based company, has announced plans to upgrade its humanoid robot with a new model designed for commercial and industrial applications. The company will be retiring its hydraulic…

Chocolate Bijoux: How Science and Passion Combine in a Baton Rouge Startup

A local small business in Baton Rouge is combining chocolate and science in a unique way. The business, Chocolate Bijoux, is run by LSU student Maram Khalaf and her mother,…