- Sat. Apr 27th, 2024

Latest Post

Mars Drilling on Hold: Scientists Evaluate Potential Target ‘Aberlady’

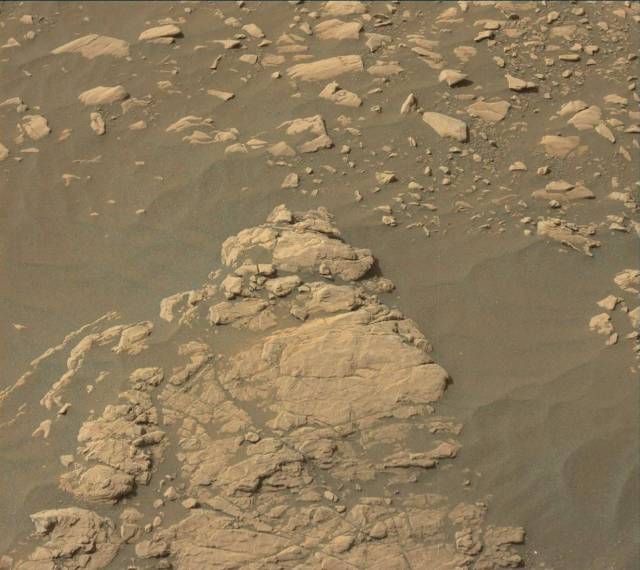

On Monday, we embarked on a short drive that led to the discovery of two potential drill targets. The prime candidate, known as “Aberlady,” displayed striking similarities in color, structure,…

The Rise of Military Investments in 2021: A Closer Look at European, Asian and Australian Defense Budgets

The trend of increasing defense budgets has been on the rise for the past year, with countries worldwide following suit. Leading the way are European Union countries, which have been…

Unveiling Mars’ Inner Secrets: Curiosity Rover’s Final Destination at Highfield Drill Site

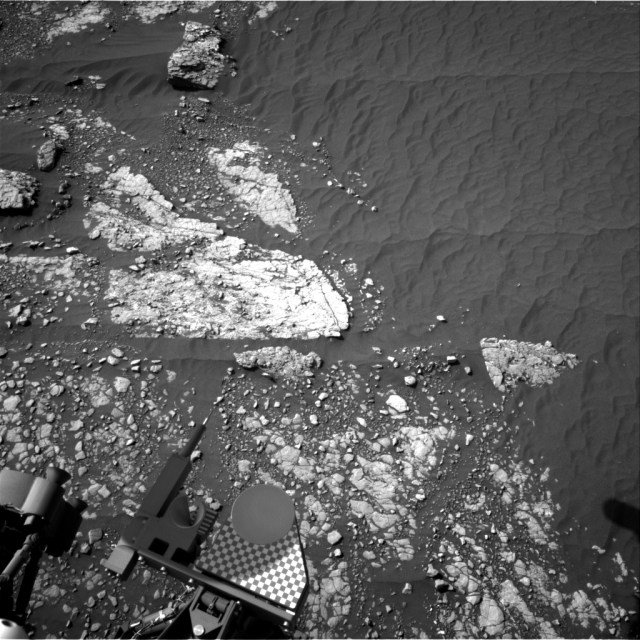

The Highfield drill site was the final destination for the Curiosity rover last week. As the Surface Properties Scientist (SPS) on shift, I noted that there were no new tasks…

Unraveling the Secrets of Mars: The Science Team’s Quest for High Potassium Levels at Broad Cairn

The science team at “Hallaig” wasted no time in beginning their investigation of a potential drill target known as “Broad Cairn.” This spot, located on a bright block within the…

Athletes Challenge Geolocation Tracking in Iowa: Balancing Privacy Rights and Public Safety Interests

In America, privacy remains a significant concern with strict limitations in place to prevent government intrusion. This has been highlighted in Iowa, where a group of 26 athletes has taken…

Searching for the Perfect Drilling Target: The Curiosity Mars Rover’s Journey to Region C

The team was optimistic for a productive day on Sol 2256, with plans for contact science and drilling on Mars. However, the workspace turned out to be unsuitable for drilling…

Healthy Eating for a Healthy Mind: The Anti-Inflammatory Foods to Boost Your Mood and Reduce Disease Risk

According to Professor Howard E. LeWine from Harvard University, who specializes in nutrition and epidemiology, consuming certain foods can improve mental health and reduce the risk of serious diseases such…

Sporting KC to Face Minnesota United FC on Saturday Night: Health Report and Insights into Players’ Performance

Sporting Kansas City is set to face Minnesota United FC at Allianz Field on Saturday night. The upcoming match promises to be an exciting event for both teams. However, unfortunately,…

Mars Science Mission Comes to a Close: Unveiling Secrets of Red Planet with Vera Rubin Ridge

As we approach the winter solstice on Earth and the days lengthen, the Vera Rubin Ridge mission on Mars is coming to a close. The team is eager to share…

Climate Change Science Under Scrutiny: How Assumptions Shape Predictions and Why We Need a More Critical Approach

In a recent talk, Ken Ham, a well-known author, blogger, and speaker, addressed the topic of climate change science and its history of failed predictions. Ham emphasized that many of…