- Fri. Apr 26th, 2024

Latest Post

Bexar County Approves $5 Million Investment in Groundbreaking New Sports Facility for UTSA: The Roadrunner NEST to be a Community Hub for Sports and Athletics

Bexar County commissioners recently approved a $5 million investment into the construction of a new sports facility at UTSA. The “Roadrunner NEST,” which stands for “Nurturing Elite Sports Talent,” will…

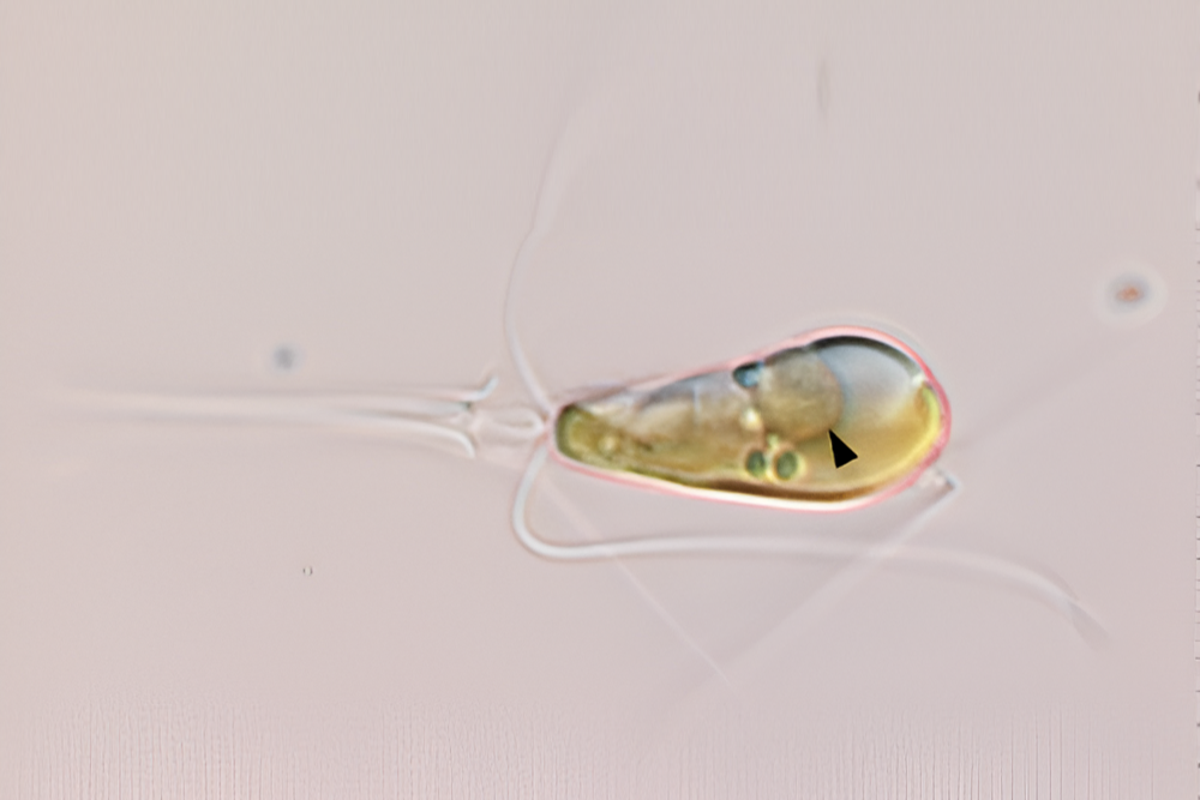

New Discovery Reveals Unprecedented Life Merger: A Revolution in Agriculture on the Horizon

The discovery of a rare occurrence in the evolutionary history of life on Earth has sent shockwaves through the scientific community. For the first time in over a billion years,…

Music World and D’Addario Partner with TerraCycle to Reduce Guitar String Waste through Recycling Events

In recent years, Matt Gohlke, the co-owner and general manager of Music World in Hazel Dell, has become increasingly aware of the environmental impact of disposing old instrument strings. He…

Honeywell’s FT Unicracking Technology: Producing SAF from Biomass with Lower Environmental Impact and Higher Efficiency

Honeywell has introduced a new hydrocracking technology that can produce sustainable aviation fuel (SAF) from biomass, making the fuel 90% less carbon intensive than traditional fossil-based jet fuels. This technology…

Jets Trade Down in NFL Draft, Select Olu Fashanu to Bolster Offensive Line Depth

On Thursday night, the New York Jets made a move in the NFL draft by trading down one spot and selecting Penn State offensive tackle Olu Fashanu with the 11th…

Vaccinate Now, Save Lives: New Jersey’s Call to Action for Infant Immunization Week 2021″.

The National Infant Immunization Week is being celebrated in New Jersey with a call to action from the Department of Health. This year, the focus is on raising awareness about…

Breaking News: Biden Approves Delivery of Long-Range Missile System to Ukraine Amidst Escalating Conflict with Russia

On Wednesday, it was reported that President Joe Biden had approved the delivery of a long-range Atacms missile system to Ukraine in February. The shipment of the missiles was kept…

Hybrid Renewable Energy Solutions: PNOC Partners with WindStream Energy Technologies for Sustainable Electricity in Off-Grid Communities

In a bid to improve energy access and sustainability in off-grid communities, the Philippine National Oil Co. (PNOC) has partnered with WindStream Energy Technologies India Pvt Ltd., an Indian renewable…

The Art of Detecting Deception: The Hidden Side of Due Diligence with Ex-CIA Officer Phil Houston”.

When it comes to due diligence, many investors focus on analyzing financial data and statements to assess a company’s potential. However, an often-overlooked aspect of due diligence is the art…

The Surprising Rise of AI-Driven Language in Scientific Studies: A Cautionary Tale

A librarian at University College London, Andrew Gray, made a surprising discovery after analyzing five million scientific studies published last year. He found a sudden increase in the use of…